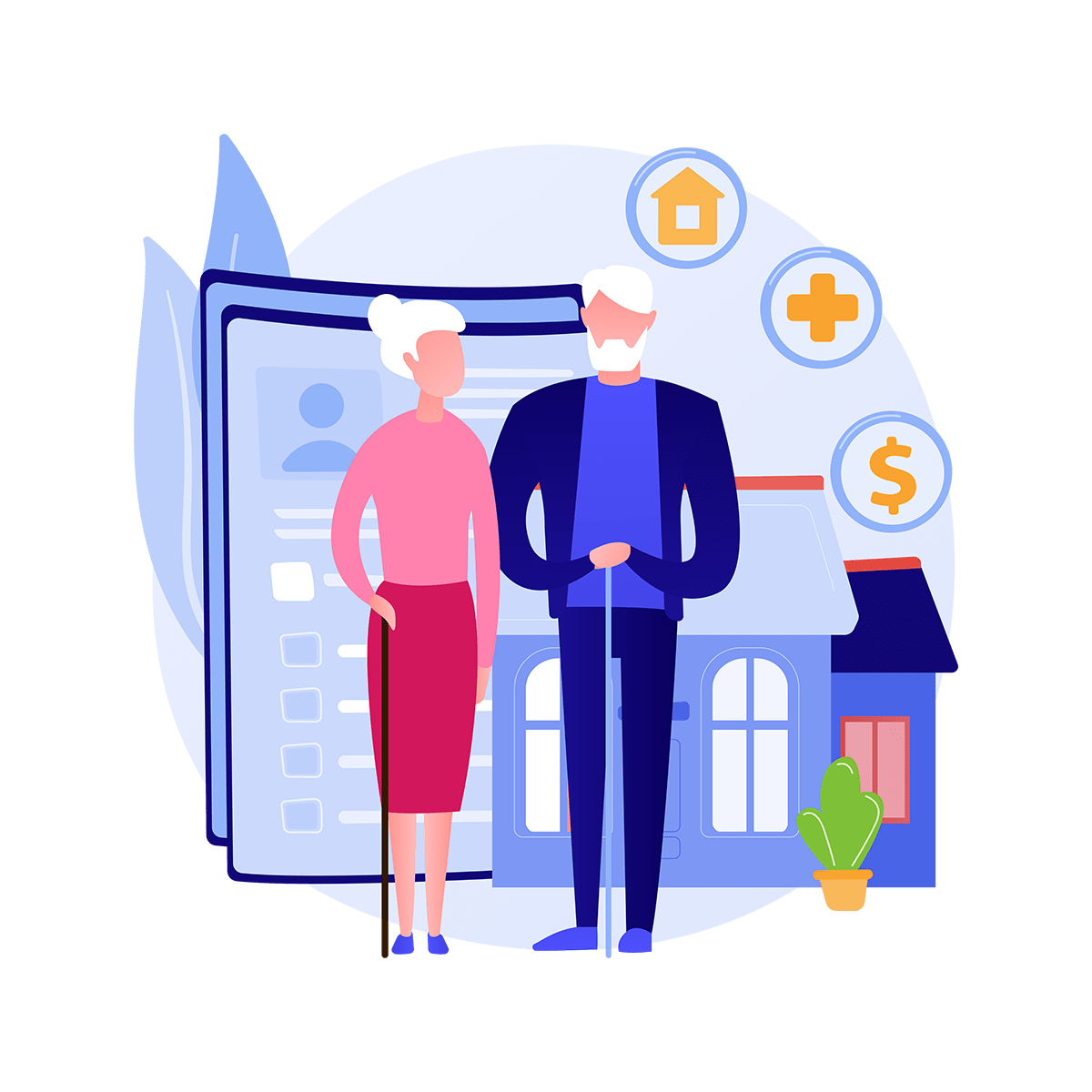

What is a Pension Plan?

A pension plan ensures retirement income from insurance companies on a regular or lump sum basis for premiums paid over time. These plans help people who want to plan a peaceful retirement with much-needed financial freedom.

Why Should You Take a Pension Plan?

When you retire or grow old, the chances of earning money are slim, and you might have to depend on other family members for your financial needs. A pension plan provides financial freedom even in old age. You can go on a trip with your friends or you can invest or buy something useful for your grandchildren.

Types of Pension Plans in India

- ULIP Investments

- Deferred Annuity

- Immediate Annuity

- Guaranteed period annuity

- Pension plans with life cover

- Annuity certain

- Life annuity

Who Should Buy a Pension Plan?

Every individual who wants a reasonable living standard post retirement with fixed returns every year should buy a pension plan. You can buy a pension plan even at the age of twenty. So, plan early rather than never and opt for a pension plan for a secured post-retirement life.